Capital alone doesn’t move technologies into the real world.

The journey from promising prototype to deployed solution runs through supply chains, procurement processes, infrastructure constraints, and customer validation. These are areas where startups often lack access, context, or leverage.

Enter corporate venture investing.

CVCs open pathways into manufacturing ecosystems, offering decades of technical and commercial insight, and providing the long-term backing required to survive the messy middle between pilot and scale.

Not to mention, a strong relationship with a corporate can shape how startups find product–market fit and navigate industrial realities.

This week we spoke with 12 CVC investors to unpack the myths around speed, commitment, and control; explore the blind spots founders repeatedly encounter and understand how investment priorities are evolving, all to give you a head start in your first/next corporate collaboration.

Close your next deal or unlock new funding pathways in Lausanne, Switzerland

100s of Investors (CVCs, VCs, Angels, LPs, Foundations, Family Offices) will be heading to the HackSummit on April 22-23rd. Make sure you’re in the mix.

In today’s edition:

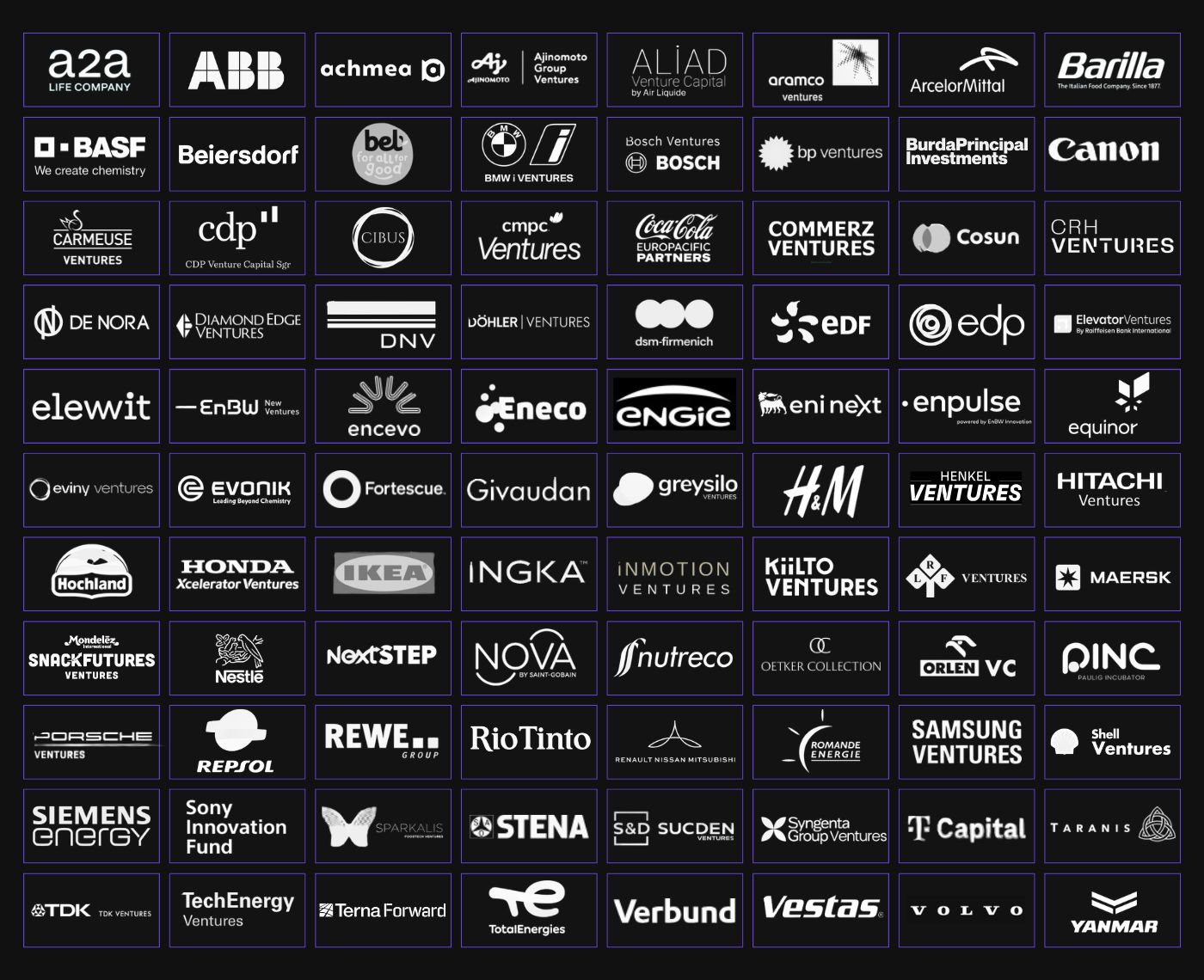

🗝️ 88 European CVCs, Mapped

💸 What 12 CVCs want Founders to Know

🚀 Demo your solution in the Startup Fair

🎤 Founders join the HackSummit Lineup

💰 20 Early-Confirmed Investors in Lausanne

🗝️ Europe’s Most Active Climate and HardTech CVCs

If you’re building in climate or hardtech, corporate capital is increasingly hard to ignore.

Beyond funding, the right CVC can unlock pilots, manufacturing capacity, regulatory pathways, and first customers, if you know where alignment exists.

We’ve compiled 80+ of Europe’s most active Climate and HardTech CVCs in one place.

Dive into the list to understand who’s investing, where they focus, where they’re based and which strategics could help you scale.

🤝 How to Work with Us, According to 12 CVCs

The uncomfortable reality for Founders is that the hardest part of scaling climate and bio-industrial innovation isn’t the breakthrough, it’s navigating the systems that decide whether that breakthrough ever leaves pilot scale.

Infrastructure gatekeepers, regulatory friction, industrial timelines, procurement logic. These forces quietly determine who scales and who stalls.

Corporate venture capital sits right at the center of that tension. But despite the growing hype, most founders still misunderstand how these investors actually operate.

This week, we went straight to the source and asked 12 CVC investors across Europe’s climate and hardtech landscape where founders get it wrong and how to get it right.

Dive in for patterns, misconceptions, and practical advice straight from the Investors scouting new deals and collaborations at EDF Pulse Ventures, EDP Ventures, Henkel Ventures, PINC, Honda Innovations, Carmeuse Ventures, VERBUND X Ventures, Inmotion Ventures, NextSTEP, Hitachi Ventures, REWE Group and Maersk Growth.

🔦 Stand out from the Crowd

Are you ready to position your startup as one of Europe’s most promising HardTechs?

Then it’s time to secure your spot in the HackSummit Startup Fair.

The Startup Fair is central to the HackSummit and it is where up-and-coming Founders demo their technology, attract investors and potential partners and get the word out about their solution.

Apply today if you’re building in climate, industrial, food, energy, materials, or deep tech, and showcase your solution to a highly targeted audience.

⚡️ Engineering Next-Generation Infrastructure

Two founders building the hardware backbone of the net-zero transition are next to join the HackSummit line-up.

Across large-scale battery storage and synthetic fuels, Voltfang and Rivan Industries are pushing the frontier of climate engineering and will join us on stage to share their journey and pathways to scale.

David Oudsandji, CEO and Co-Founder at Voltfang. Decentralizing the grid with smart and sustainable storage systems. David is scaling ready-to-use energy solutions incl. battery storage to store renewable energies in a sustainable way.

Harvey Hodd, CEO and Founder at Rivan Industries. Designing, manufacturing and deploying synthetic fuel plants, Harvey is on a mission to make it cheaper to pull fuels from the air than drill from the ground.

💸 Investors Already in the Room

A Snapshot of Early Confirmed Investors

Surround yourself in top-tier company at the HackSummit. With a growing line-up of stellar Founders and Investors joining us, you’ll be in the room where ideas turn into impact.

The early bird ends next Friday. Secure your place today to lock in the best rate and get ready for 48 hours of high-impact dealmaking and networking.

See you at HackSummit, where momentum is built.

Laura at Hack

Tell us, what did you think of today’s email?