Look up at the night sky. Every star is powered by nuclear fusion, the process of smashing atoms together to release energy.

Scientists have been chasing this same reaction on Earth for decades, with the promise of limitless, clean, always-on power.

Now, with fresh breakthroughs and billions in new investment, nuclear is heating up again.

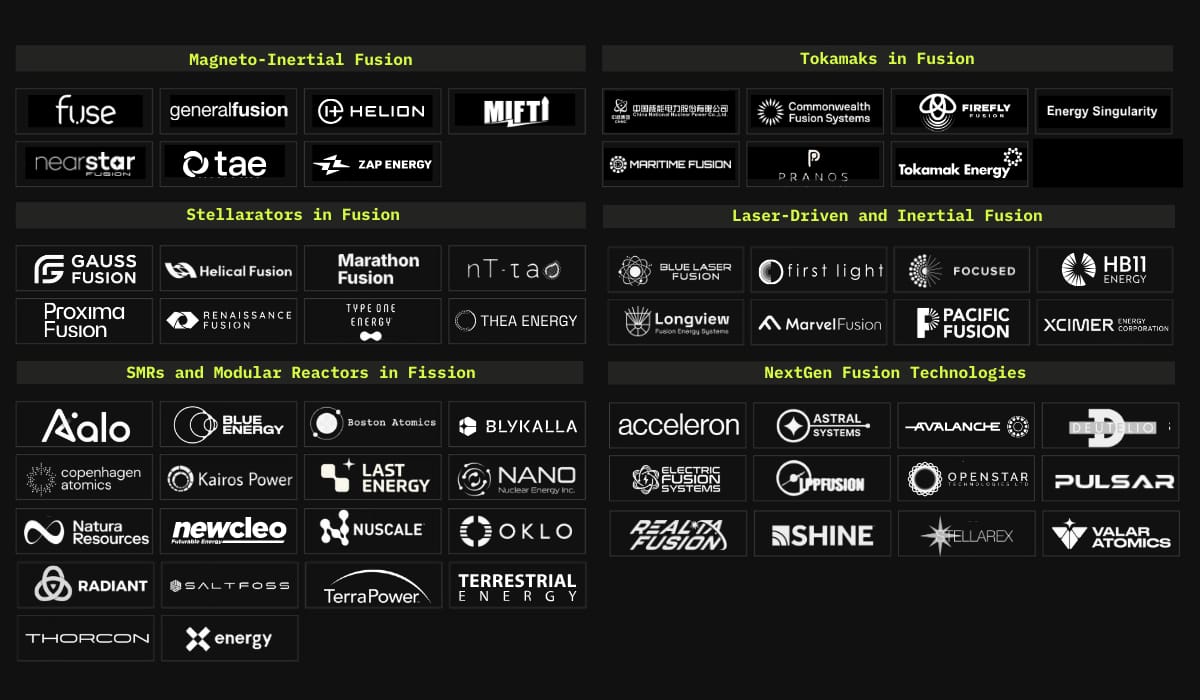

The global fusion market could hit nearly $600 billion by 2030, with over $9 billion in funding already invested, as the contest between lasers, tokamaks, stellarators, and modular reactors accelerates.

And fission, once considered yesterday’s technology, is also re-emerging with new designs that promise safer, smaller, and faster-to-deploy reactors.

While the prize is enormous: carbon-free energy from the same reaction that powers the stars, there’s a catch. There isn’t one path to nuclear.

Different teams are betting on radically different designs, each with its own strengths, challenges, and champions.

Hundreds of Founding teams building radically different technologies for abundance in Climate DeepTech will join us at the HackSummit in New York this December 10-11th. Now is the time to book your place and join them there.

Fission vs Fusion

"As promising as fusion appears, despite decades of effort, it has never produced any electrons for the grid. In contrast, fission has been putting electrons on the grid for almost 70 years, yielding troves of test, material, production and operating data.

Thus, SMR developers are not facing technology risk as much as commercialization risk. For several decades, regulatory hurdles slowed fission innovators. However, bipartisan passage of the ADVANCE Act in 2024, and four nuclear-focused Executive Orders aimed at accelerating commercialization have lit a fire.

The DOE has already selected nearly a dozen teams to participate in its accelerated design review pilot program and get something built and operating by July 4th, 2026. Which, if even just a few succeed, will make the coming year quite exciting by fission standards," Valerie Gardner, Managing Partner of Nucleation Capital

“Tokamaks have long led the way in fusion, with ITER setting the foundation and companies like CFS pushing the boundaries.

That said, Stellarators have gained serious momentum over the last year and a half because of their inherent stability advantages.

With several well-capitalized contenders, it’s too early to tell which technology will ultimately win, but the race to commercial fusion is unquestionably on,” Robin Neff, Investor Manager at World Fund tells us.

60 Nuclear Fusion and Fission Trailblazers

🔦 Laser-driven fusion and inertial fusion energy

Credit: First Light Fusion

How it Works: Laser beams compress tiny fuel pellets until they implode, recreating the heat and pressure inside a star. Inertial Fusion Energy can use schemes other than lasers, such as Pulsed Power machines (giant capacitor banks to deposit electricity).

The Pitch: Proven breakthroughs, potential scalability. Inertial Fusion Energy is significantly less complex and less expensive.

The Challenge: Gigantic lasers are complex and expensive.

Recent Milestone: The US National Ignition Facility recently made a scientific gain using this technology.

“Our focus is on the target itself, through target-based power amplification. By perfecting the target, we make every other system challenge, whether it’s efficiency, stability, or scalability far easier to overcome. That’s the key to unlocking inertial fusion energy in a practical, commercially viable way,” explains David Bryon, CFO at First Light Fusion.

Scaleups (and recent funding):

🇺🇸 Blue Laser Fusion ($37.5 million Seed)

🇬🇧 First Light Fusion ($135 million+)

🇺🇸 Focused Energy ($175 million)

🇦🇺 HB11 Energy (approx $10 million)

🇺🇸 Longview Fusion Energy Systems (Undisclosed)

🇩🇪 Marvel Fusion (€385 million)

🇺🇸 Pacific Fusion ($900 million Series A)

🇺🇸 Xcimer Energy ($100 million Series A)

🍩 Tokamaks in Fusion

Credit: Commonwealth Fusion Systems

How it Works: Magnetic fields confine plasma in a doughnut-shaped chamber, keeping it hot enough to fuse.

The Pitch: A widely studied and stable design, with decades of research.

The Challenge: Maintaining the plasma requires extremely strong magnetic fields.

Recent Milestone: The West machine at Cadarache in France set a new record by maintaining plasma for +22 minutes.

“Firefly is deploying proven copper-magnet technologies to rapidly advance solutions for safely managing fusion energy production and heat exhaust. It’s thanks to decades of research and tens of billions in public support, that we now have all the ingredients to scale tokamaks from research devices to energy-producing plants,” says Rustem Ospanov Founder and CEO of Firefly Fusion.

“Public-private partnership is key to commercialising fusion, and we are working with governments on leading national programmes, including a partnership with DESNZ and the U.S. Department of Energy for a $52m upgrade to our record-breaking and operational spherical tokamak ST40. It’s a really exciting time for Tokamak Energy. Our team combines the business, scientific, engineering, and industrial expertise and experience needed to take fusion from research to commercial reality, and we will adapt and license our technology to support major public-private fusion initiatives across the globe. It’s clear the world needs a new form of clean, secure energy and fusion is the answer,” explains Itxaso Ariza, CTO at Tokamak Energy.

Startups and Scaleups (and recent funding):

🇨🇳 China Fusion Energy Co (about $2.1 billion)

🇺🇸 Commonwealth Fusion Systems ($863 million Series B2)

🇨🇳 Energy Singularity ($121 million)

🇫🇷 Firefly Fusion ($160K)

🇺🇸 Maritime Fusion ($500K)

🇮🇳 Pranos Fusion ($417K)

🇬🇧 Tokamak Energy ($125 million)

⭐ Stellarators in Fusion

Credit: Proxima Fusion

How it Works: It uses external coils to generate a twisting magnetic field to control the plasma

The Pitch: They can operate continuously without the need for a plasma current.

The Challenge: Complex magnet coil configurations and geometry.

Recent Milestone: Wendelstein 7-X Stellarator broke a key record to demonstrate its viability and commercialization potential.

“Thea Energy is building a maintainable and dynamically controllable stellarator system. Thea Energy's planar coil stellarator architecture utilizes arrays of mass-manufacturable magnets paired with software controls. By shifting system complexity from hardware to software, we've significantly relaxed precision requirements and can also tune out wear-and-tear over a power plant’s lifetime,” explains Brian Berzin, CEO of Thea Energy

“nT-Tao is developing a modular 20 MW compact fusion system for the global shift to distributed baseload energy. Our unique integration of mature technologies; magnetic confinement and efficient pulsed heating, enables rapid engineering cycles that systematically de-risk development. Our System is scalable from remote, off-grid markets to full grid connection in growing global demand,” says Nimrod Ganzarski of nT-Tao Compact Fusion Power.

"Isotope separation technology is core to the success of fusion power plants, as well as MSRs on the fission side. We need new technologies capable of high throughput separation of lithium, hydrogen and other isotopes to be able to meet the demands of these new power plants. Marathon Fusion has been developing our plasma centrifuge for this application and is proud to be working with the Department of Energy, Savannah River National Laboratory and leaders in private industry as we take our technology to large scale deployment," summarises Kyle Schiller, CEO of Marathon Fusion.

Scaleups (and recent funding):

🇩🇪 Gauss Fusion (€10 million grant)

🇯🇵 Helical Fusion ($15.6 million Series A)

🇺🇸 Marathon Fusion ($5.9 million Seed)

🇮🇱 nT-Tao Compact Fusion Power ($28 million)

🇩🇪 Proxima Fusion (€130 million Series A)

🇫🇷 Renaissance Fusion ($33 million Series A1)

🇺🇸 Thea Energy ($20 million Series A)

🇺🇸 Type One Energy ($82.4 million Seed)

Meet the Climate Deep Tech Community IRL

Tickets to the upcoming HackSummit in New York (10-11th December) are selling fast.

500 industry mavericks and disruptors behind novel climate tech solutions are heading to New York at the end of 2025 for two days of networking and deal making across all things climate deep tech.

Ready to join in? Head this way to book your place.

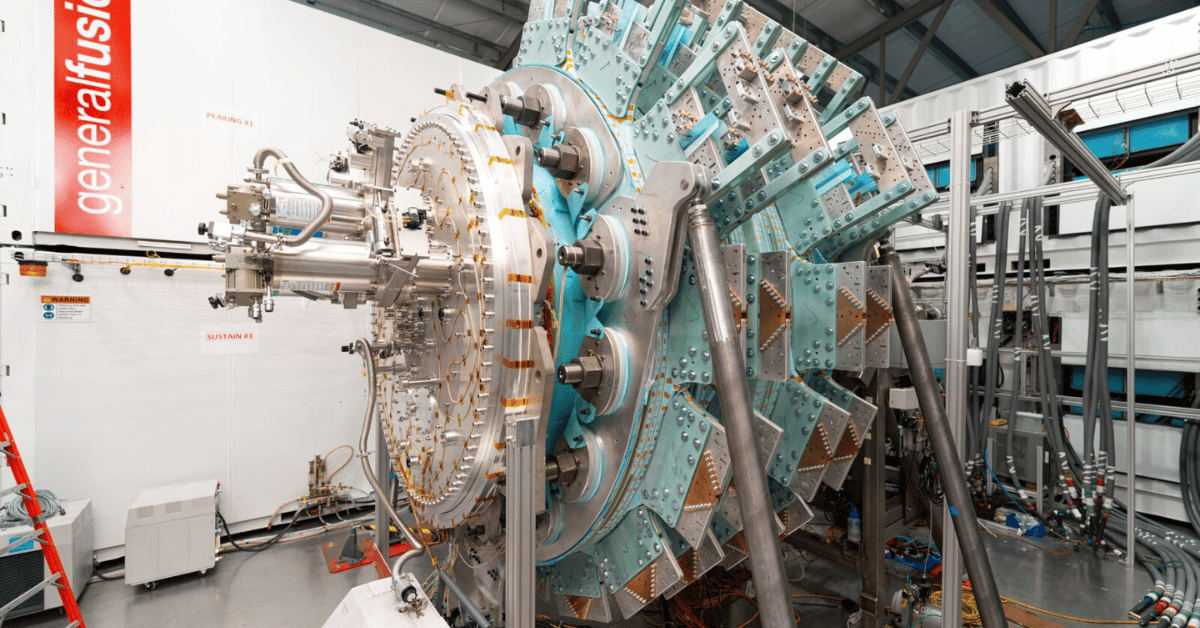

🧲 Magneto-inertial Fusion

Credit: General Fusion

How it Works: Combines magnetic fields with pulsed compression to heat and confine plasma.

The Pitch: A faster, cheaper path than tokamaks or laser fusion, with simpler engineering.

The Challenge: Plasma instabilities and material stresses remain major hurdles, and net gain is unproven.

Recent Milestone: Microsoft signed a 2028 power deal with Helion to use fusion energy.

“NearStar Fusion is developing fusion energy power plants (50-100MW) based on extensive expertise in hypervelocity railgun technology and building plasma guns for fusion experiments at Los Alamos National Laboratory. Using a linear railgun as the fusion driver simplifies the overall power plant design by leveraging commercial-off-the-shelf (COTS) components, using a liquid first wall for heat capture and neutron-embrittlement, and allowing a proprietary magneto-inertial fusion fuel target with deuterium-deuterium (D-D) to avoid tritium breeding and supply chain concerns. NearStar Fusion’s Magnetized Impact Target Fusion (MTIF) approach is scalable and modular to enable rapid mass production and deployment across the globe,” explains Amit Singh, CEO of NearStar Fusion.

Scaleups (and recent funding):

🇬🇧 Fuse ($32 million)

🇨🇦 General Fusion ($440 million)

🇺🇸 Helion Energy ($425 million Series F)

🇺🇸 Magneto-Inertial Fusion Technologies (Undisclosed)

🇺🇸 NearStar Fusion ($8 million)

🇺🇸 TAE Technologies ($1.3 billion)

🇺🇸 Zap Energy ($130 million Series D)

⚡️ SMRs and Modular Reactors in Fission

Credit: Aalo Atomics

How it Works: Designed to be smaller, factory-built, and transportable, they use standardized modules that can be assembled on-site, often with enhanced safety features and passive cooling.

The Pitch: They are fast to deploy, lower upfront costs, and more flexible than traditional nuclear plants.

The Challenge: Regulatory approvals remain lengthy and costly, with high construction costs and competition from cheaper renewables.

Recent Milestone: The US Nuclear Regulatory Commission approved NuScale’s SMR design in 2023, marking the first-ever federal certification of a small modular reactor in the United States.

“NANO Nuclear Energy Inc. is the first vertically integrated microreactor company publicly listed on NASDAQ. The patented KRONOS MMR™ Energy System, a stationary high-temperature gas-cooled microreactor that is in construction permit pre-application engagement U.S. Nuclear Regulatory Commission (NRC) in collaboration with University of Illinois Urbana-Champaign and exploring a demonstration project with Chalk River Laboratories in Ontario, Canada,” reveals Jay Yu Founder and Executive Chairman of NANO Nuclear Energy Inc

Scaleups (and recent funding):

🇺🇸 Aalo Atomics ($100 million Series B)

🇺🇸 Boston Atomics (Undisclosed)

🇺🇸 Blue Energy ($45 million Series A)

🇸🇪 Blykalla (SEK 80 million)

🇩🇰 Copenhagen Atomics (€2.5 million grant)

🇺🇸 Kairos Power ($303 million DOE)

🇺🇸 Last Energy ($40 million Series B)

🇺🇸 NANO Nuclear Energy Inc ($250 million)

🇺🇸 Natura Resources ($20 million equity funding)

🇫🇷 Newcleo ($135 million Series A)

🇺🇸 NuScale Power ($227 million)

🇺🇸 Oklo ($400 million)

🇺🇸 Radiant ($165 million Series C)

🇩🇰 Saltfoss ($6 million Seed)

🇺🇸 Terrapower ($1.4 billion)

🇺🇸 Terrestrial Energy ($118 million)

🇸🇬 ThorCon (Undisclosed)

🇺🇸 X-Energy ($700 million Series C1)

💥 Nextgen Fusion Technologies

Credit: Acceleron

Beyond tokamaks and lasers, a wave of next generation approaches is expanding the frontier of fusion.

"At Realta Fusion, we’re developing compact, scalable, modular – CoSMo fusion™– energy systems based on a concept known as the magnetic mirror, which offers the lowest cost and shortest pathway to commercial fusion energy. We’re ideally suited to delivering industrial heat and power on site for a wide range of applications, including data centers, chemical plants, metal recycling, remote mining, and other heavy industry. The mirror is an old concept revived by new advances in key components such as HTS magnets. While tokamaks and laser-driven approaches might lead the race for eyeballs, we're confident the mirror gets us to commercial fusion faster. The smart money is on the mirror," notes Kieran Furlong, CEO and Co-Founder of Realta Fusion.

“While others focus on reactor designs, we're focused on markets. We've successfully commercialized fusion across several applications, including neutron testing markets such as neutron radiography, radiation-effects testing and fusion material research. We have commercialized and are scaling our proprietary medical isotope production processes, supplying high-quality radioisotopes essential for procedures including diagnosing heart disease and cancer as well as cancer therapy. At SHINE Technologies, our revenue-generating approach builds the industrial base and expertise needed to make fusion energy cost-competitive. We're also pioneering nuclear waste recycling, turning today's nuclear challenge into tomorrow's fuel while advancing toward abundant clean energy,” explains Greg Piefer, Founder and CEO of SHINE Technologies.

These 12 startups are pushing fresh designs and daring physics experiments that could redefine the path to practical fusion energy, here’s how:

🇺🇸 Acceleron Fusion ($24 million Series A) High-efficiency muon source to produce beams of muons and a high-density fusion cell to allow each of these muons to catalyze larger numbers of fusion reactions.

🇬🇧 Astral Systems (€5.3 million Seed) Manufacturing nextgen compact fusion reactors enabling immediate medical and industrial applications.

🇺🇸 Avalanche Energy ($40 million Series A + $10 million Grant) Supplying services for the emerging neutron markets and for rapidly scalable, remote power needs.

🇨🇭 Deutelio (undisclosed) A poloidal magnetic configuration designed for enhanced efficiency and performance in fusion energy.

🇺🇸 Electric Fusion Systems (undisclosed) Direct-to-electricity technology that integrates their patent-pending proton-lithium Rydberg matter fusion fuel with a pulsed electrical stimulation breakthrough.

🇬🇧 LPP Fusion (undisclosed) Using a dense plasma focus (DPF) device.

🇳🇿 OpenStar Technologies ($12 million) Levitated dipole reactor concept for fusion energy generation at grid scale

🇬🇧 Pulsar (undisclosed) A space propulsion systems and services company delivering state-of-the-art propulsion through fusion technology.

🇺🇸 Realta Fusion ($36 million Series A) Developing compact, scalable, modular (CoSMo) fusion energy systems for the production of industrial heat and power.

🇨🇦 Stellarex (DOE-funded) A spin-off of Princeton University applying the advantages of the stellarator approach to fusion energy development.

🇺🇸 SHINE Technologies ($800 million) Commercializing fusion technology across multiple markets: neutron testing applications, medical isotope production, nuclear waste recycling, and ultimately fusion energy generation.

🇺🇸 Valar atomics ($19 million Seed) Creating oil and gas from atmospheric elements with the power of atomic energy.